While scanning the news headlines this week I ran across an article titled “What Is the Average Price per Square Foot for a Home — and Why Does It Matter?” Because I am an appraiser this caught my eye for various reasons.

The article pointed out that you can use the average price per square foot of the sales in the neighborhood to gauge whether you are getting a good deal when buying a house. I have a problem with this because it places too much emphasis on a stat that does not tell the whole story of a property’s value.

The first and foremost goal of my blog is to inform and educate the public about appraisals as well as why and how appraisers do what they do. This includes clarifying confusing information that consumers may have about the appraisal profession or about their homes value.

More things to consider

Narrowing down the value of a property based only price per square foot, such as what was eluded to in the article, does not tell the whole story. When you only look at the price per square foot metric you don’t take into consideration variations in the type of properties that are in a neighborhood.

The price per square foot relies heavily on having accurate information about the gross living area of the comparables, which is not always known. Lastly, when you look ONLY at price per square foot you place more emphasis on the moving target of value as opposed to the more reliable physical attributes of the property.

Value can be a moving target because most people have in their mind a preconceived notion of what their home is worth and this can lead them into choosing sales that support the value they want.

I’m interested in educating the public about the fallacies of only looking at price per square foot because it can lead to inaccuracies when estimating the value of your home, especially when you use it to arrive at an asking price for your home.

Price per square foot can provide a reasonable estimate of value in certain situations. If there is a high degree of similarity among houses in the neighborhood with regard to size, quality, design, and appeal then looking at price per square foot can give you a reliable range of value.

When properties are similar, the need to make adjustments is reduced. If all of the houses are on similar size lots, have the same number of bedrooms and bathrooms, are close in age, and are similar in living area then looking at the price per square foot may give you a range of value that you can then use to reconcile a value for your property.

When there are more variations in the elements of comparison this will impact the price per square foot. For example, a larger home will sell for less per square foot when everything else is similar and a smaller home will sell for more.

A home that has a finished basement will sell for more than a similar home without a basement. This is important because if you only look at price per square foot you may use a value indicator that does not accurately reflect your home’s true value.

The one thing you must know

Even if you have comparable sales that are similar in most regards you must make sure that you know exactly how big they are in terms of gross living area (GLA). The GLA is what appraisers use when arriving at a price per square foot in their appraisal reports. You must have accurate square footage in order to calculate the price per square that you use to come up with your home’s value.

If the GLA of your comparable sale is wrong and your price per square foot is wrong by as little as $10 this can cause the value estimate for your home to be off by $10,000 for a 1,000 square foot home.

When you only look at price per square foot you don’t necessarily take into consideration all of the other physical attributes of the home. These physical features of your home should be what you use to “bracket” the sales during comp selection because the features of a property are what drives value.

Rather than looking at the average price per square foot of ALL the sales in a neighborhood you should do a comp search by picking those sales that are similar in the size, age, condition and features of your home because the price per square foot that they sell for will reflect the similar features that your home has.

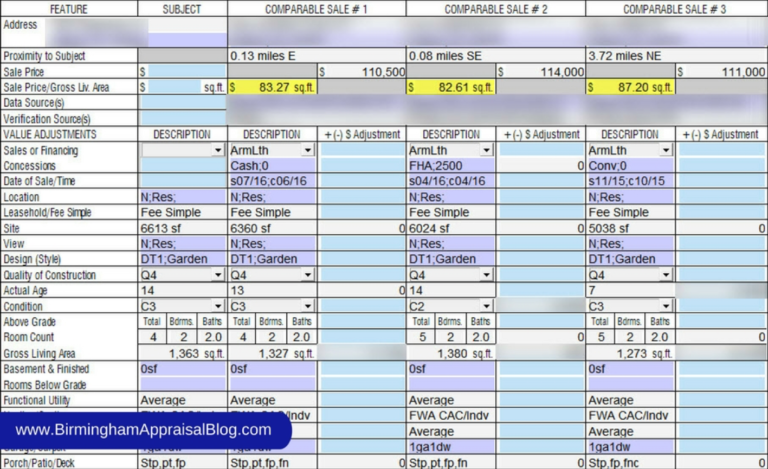

Below you will see a typical sales comparison grid from a recent appraisal I did. My comp search consisted of bracketing the physical features of the property. As a result, the price per square foot was fairly close and consistent. There were small variations, mainly because of differences in age, condition.

A search of the neighborhood without regard to any physical differences resulted in a range in price per square foot from $48 to $108. The spread of $60 from the lowest to the highest leaves a lot of room for error. This range is because of the variations in physical characteristics like I mentioned previously such as size, bedroom/bath count, age, etc.

Looking at all sales is using a shotgun approach but bracketing the physical characteristics of the property and narrowing your search down is more like using a rifle because the results are more closely targeted and accurate. This will provide a more accurate value indication and will help sell the home more quickly because the home is priced to the market.

This article was originally published by Tom Horn. For additional articles by Tom Horn visit his website.